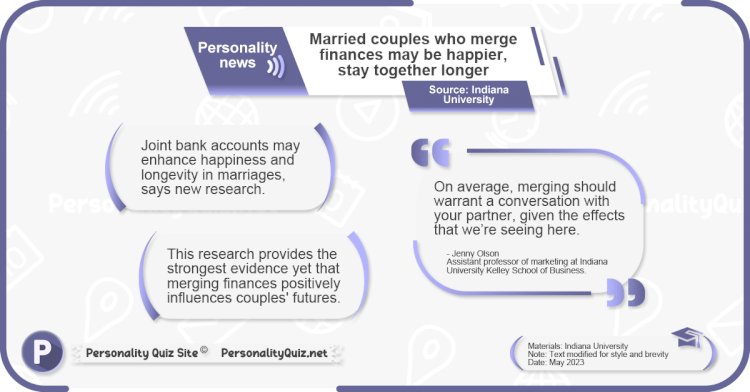

Married couples who merge finances may be happier, stay together longer

Merging finances may boost happiness, longevity in marriages, says Indiana University study.

Summary

According to research from the Indiana University Kelley School of Business, married couples who manage their finances together may experience longer-lasting and happier marriages. This is the first research showing a causal relationship between joint bank accounts and better marital relations.

Introduction

"Money can't buy me love," sang the Beatles, but a new study indicates that couples who jointly handle their finances may love each other for a longer duration. The Indiana University Kelley School of Business explored this correlation and made some intriguing discoveries.

Main points

- The study suggests that married couples with joint bank accounts not only have improved relationships, but they also have fewer disagreements over money and better household financial management. This outcome was observed over a two-year period among couples who initially had separate accounts but decided to merge their finances

- Assistant Professor Jenny Olson explained that a 'we' perspective was evident among couples with joint accounts. These couples saw their relationships as communal and aligned with their financial goals, fostering a higher quality relationship compared to those who maintained separate accounts

- An interesting observation was that couples with separate accounts viewed financial decision-making more transactionally, akin to business-type relationships. They might think it's easier to leave the relationship, and a significant percentage of them did separate during the study.

Conclusion

In conclusion, the research provides compelling evidence that merging finances may contribute to higher quality and longer-lasting marriages. It might be beneficial for couples to discuss the idea of joint bank accounts as it can promote greater financial alignment and a more communal understanding of marriage.

Source and credits

Materials: Indiana University

Note: text modified for style and brevity

Date: May 2023

Research reference

Journal of Consumer Research, 2023

vneo

vneo